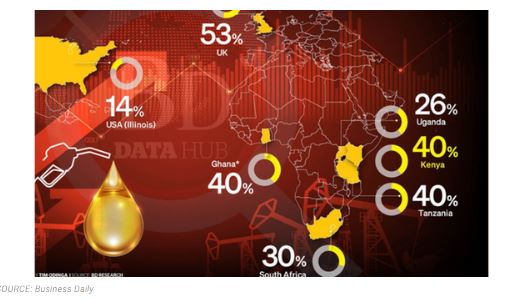

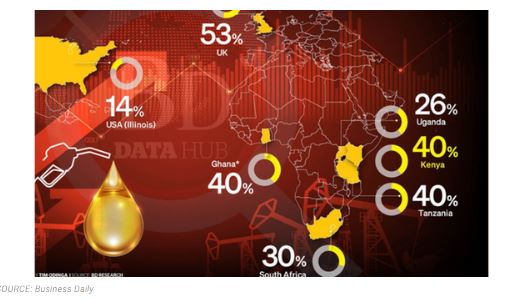

Tanzania and Kenya are in the league of countries collecting the highest taxes on fuel, calculated as a percentage of the final price, overtaking bigger economies such as the US and South Africa.

Though Tanzania has the cheapest fuel in the region, the ratio of taxes as a percentage of the pump price ties with Kenya at 40 percent. Ethiopia on the other hand does not tax fuel.

Kenya charges seven levies and two taxes on fuel and last week doubled Value Added Tax (VAT) on the commodity to 16 percent, further increasing the taxation component for every litre of super petrol, diesel and kerosene.

The United Kingdom (UK) is one of the countries with the highest taxes on fuel in the world, with taxes accounting for 53 percent of the pump price of every litre of gasoline.

Kenya ties with Tanzania but the two rank higher than Uganda whose taxation on fuel accounts for 26 percent of the cost of a litre of fuel.

The petrol cargo is also charged Sh20 million per vessel as customs processing fee, another Sh20 million per vessel as fee for Tanzania Shipping Agencies Corporation (Tasac), Sh7 million as Weights and Measures fee and Sh12.8 million per vessel as fee for Tanzania Bureau of Standards (TBS).